Metals & Mining

Metals & Mining

“In today's competetive environment, those who achieve the highest value-added win, rater than those who achieve deeper integration, or expand more aggressively".

Vladimir Potanin,

Vedomosti, 2013

2005 - 2009

Maximize

Minimize

Polyus Gold Internationalwww.polyusgold.com

In 2005 Interros, together with other Norilsk Nickel shareholders, decided to create OJSC Polyus Gold by spinning off the gold mining assets of Norilsk Nickel (CJSC Polyus and its subsidiaries) into an independent public company. Polyus Gold shares were listed on the Russian stock exchange in the spring of 2006, and then a bit later the company was listed on the London Stock Exchange. Polyus Gold was the first company in Russia carved out of an existing company by reorganizing assets using the 1:1 share distribution method. Vladimir Potanin and Mikhail Prokhorov began to divide their business holdings in 2007. In 2009 Interros sold its stake in Polyus Gold to Suleyman Kerimov.

More

Polyus Gold International Ltd.

- Leading gold producer in Russia and Kazakhstan

- One of the largest gold-producing companies in the world by mineral reserves and gold production.

History

2002

Interros prods Norilsk Nickel to acquire CJSC Polyus, the largest gold mining company in Russia that had consolidated a significant portion of the Russian gold mining industry. The acquisition is paid for with Norilsk Nickel’s and shareholders’ own funds.

2005

Interros and other Norilsk Nickel shareholders decide to spin off the gold mining assets of Norilsk Nickel (CJSC Polyus and its subsidiaries) into OJSC Polyus Gold, an independent public company. Shares in the new company are distributed among Norilsk Nickel shareholders in a 1:1 ratio, giving every shareholder the opportunity to obtain one share of Polyus Gold for every share of the mining giant. The goal of the spin-off is to increase Norilsk Nickel and Polyus Gold valuations since gold mining companies are evaluated using different multipliers. Additionally, given the limited number of large players in the Russian mining and metals sector, a new company invariably increases the sector’s attractiveness to investors.

2006

Polyus Gold shares start being listed on the Russian stock exchanges in the spring, and on the London Stock Exchange later in the year. The company reports unprecedented results:

- The world’s fifth largest gold miner by market capitalization

- In the beginning of the year the company is valued at $12.9 bln in over-the-counter trading (which exceeds the cost of gold asset consolidation by a factor of 25)

- Norilsk Nickel trades at $90 per share prior to record date. Polyus Gold’s IPO increases Nornickel’s valuation to $130. Polyus Gold becomes the first and the largest Russian company spin-off with a 1:1 share distribution.

2007 – 2009

Vladimir Potanin and Mikhail Prokhorov begin to divide their business holdings. Prokhorov and Yevgeniy Ivanov, the top executive, gain complete control over the company by the beginning of 2008. Prokhorov becomes the Chairman of the Board. Interros loses the ability to influence the company’s strategy, production policy, and decisions at the Board of Directors, including the thorny issue of plans to spin off geological survey assets that Interros finds unacceptable and believes to be contrary to shareholders’ interests. Interros proposals to reorganize the company, separate the executive team from the Board of Directors, and replace management are blocked. Vladimir Potanin always believed that “there is no reason to continue to persevere once the whole toolkit of influence is exhausted, when you can no longer bring anything of value to the project and must put up with being a passive investor,” and so in the spring of 2009, Interros sells its stake in Polyus Gold (some 29%) for $1.3 bln to Suleyman Kerimov, a businessman. Sale proceeds are used to restructure Interros's VTB debt and restore its financial health after the 2008 financial meltdown.

Minimize

1993 - 2002

Maximize

Minimize

NLMKwww.nlmk.com

In 1995 Interros Group companies obtained a 15% stake in NLMK, the Novolipetsk Steel Plant. The shares were first placed under Interros management, and later acquired outright. The plant was co-owned by the Reforma Group, the Trans-World Group (TWG), and Vladimir Lisin, a former TWG employee until his departure in 2000. Acting via the Reforma Group, Interros developed and began implementing a new strategy for NLMK. In 2000, as a result of a shareholder reshuffle, NLMK owners included Vladimir Lisin, Norilsk Nickel, Interros and minority shareholders. In 2001 Interros’s desire to be involved in NLMK management diverged from Lisin’s strategy. A year later, Interros and Norilsk Nickel sold their 34% stake in the plant to the consortium for the benefit of Vladimir Lisin.

More

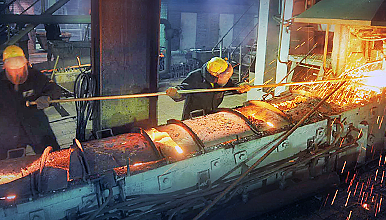

NLMK

- The largest steel producer in the world. In 2008 NLMK was producing 15% of Russia’s steel output and exporting its products to 70 countries.

- In addition to steel, NLMK produces pig iron; slabs; hot-rolled, cold-rolled and galvanized rolled products; polymer-coated steel; transformer and dynamo steel; and long products.

- NLMK is a vertically integrated group of companies with production facilities in Russia, the EU and the United States.

History

1993

NLMK is privatized with vouchers. Shares in the plant are distributed among all its employees. Difficult economic conditions and poor management leave one of the world’s 25 largest steel plants in a freefall.

1995

Financial investors begin to consolidate large stakes in NLMK. UNEXIM-MFK Group receives some 15% of the steel plant’s shares under management at a shares-for-loans auction, and then subsequently acquires them.

1997

NLMK shareholders:

- Reforma group (UNEXIM-MFK, Renaissance Capital, Cambridge Capital Management) — 50% stake

- TransWorld Group (TWG) — 34%

- Vladimir Lisin, former TWG employee — 13%

- Others — 3%

The relationships between the plant’s shareholders remain strained through the end of 1997. The TWG representatives prevent Reforma Group from being involved in managing NLMK, and try to convince Vladimir Lisin to sell his stake in the company.

After a series of legal proceedings, the Reforma Group and Vladimir Lisin arrive at a common understanding of the plant’s development strategy. In December, with 63% of NLMK shares between the two of them, they manage to elect a representative Board of Directors. The Reforma Group is now in charge of strategic planning; Vladimir Lisin is responsible for the plant’s operational management.

NLMK production restructuring plan:

- Reduce costs

- Reduce barter

- Meet higher environmental standards

- Attract investments in research and development

- Implement financial control and accountability

- Create a simplified and effective organizational structure

- Perform audits in accordance with the US GAAP

NLMK is now governed by budget discipline, with two major tools used to meet budget goals: technical upgrades and cost-cutting measures.

2000

Shareholder reshuffle.

NLMK shareholders:

- Vladimir Lisin becomes the NLMK controlling shareholder by slowly acquiring Reforma’s 50% stake through Rumelko, his managing company, for what experts believe is approximately $200 mln.

- Norilsk Nickel and Interros acquire TWG’s 34% stake in the plant

- Other shareholders hold 16% of the shares

- Interros believes that there are two factors that help reap the obvious advantages of synergy with NLMK:

- Norilsk Nickel’s high demand for flat and other metal products

- NLMK is interested in having a regular supplier of copper and other alloy metals.

2001

Interros’s expressed desire to participate in NLMK management does not fit with Vladimir Lisin’s strategy. A conflict between the shareholders is brewing. Rumelko, as the managing company, holds a controlling stake in the plant and assumes full management control of the company.

2002

Interros and Norilsk Nickel sell their 34% share in NLMK for $180 mln to a consortium founded by Renaissance Capital for Vladimir Lisin’s benefit. The Interros Board of Directors does not share Rumelko’s view of NLMK development strategy. Interros expresses its satisfaction with the financial terms of the sale, which puts an end to the unproductive strife between NLMK’s shareholders.

Minimize